Auto Refinance Quote That Helps You Lower Payments and Regain Financial Control

Take action today and secure a smarter auto refinance quote. Learn how lenders evaluate your profile, what impacts approval, and how to avoid refinancing mistakes.

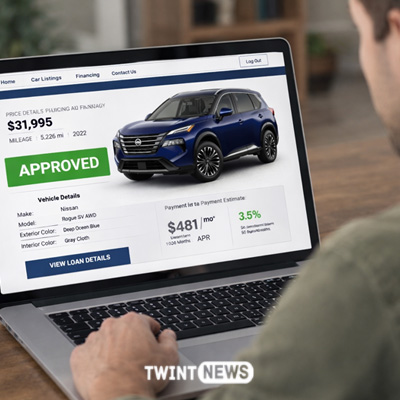

Requesting an auto refinance quote is one of the most effective ways for U.S. drivers to reduce monthly payments, lower interest rates, and restructure an existing car loan.

Many borrowers accept their original financing terms without realizing that market conditions, credit improvements, or lender competition can work strongly in their favor later.

Compare powertrains, efficiency, and safety to identify the best hybrid SUV under $35 k for your driving profile and long-term ownership.

See How a Refinance Quote Works in Practice 🧠

An auto refinance quote is a lender’s estimate of the interest rate, monthly payment, and loan term available based on your financial profile and vehicle details.

Unlike a final approval, a quote provides a structured preview of potential savings.

Lenders analyze factors such as credit score, current loan balance, vehicle age, mileage, and income stability.

The better these variables align with lender criteria, the more competitive the quote becomes.

Importantly, refinance quotes allow borrowers to compare multiple offers without committing immediately, making them a critical decision-making tool rather than a sales pitch.

Learn When Requesting a Refinance Quote Makes Sense 📉

Timing plays a major role in refinancing success. Requesting an auto refinance quote is most beneficial when certain conditions are present.

Common scenarios where refinancing is advantageous include:

- Improved credit score since the original loan

- Lower interest rates in the broader lending market

- High original APR, especially from dealership financing

- Need to reduce monthly payments for budget flexibility

- Desire to change loan term length

Drivers who refinanced under these conditions often see meaningful reductions in interest costs over the remaining loan period.

What Lenders Evaluate When Issuing a Refinance Quote 🔍

Understanding how lenders assess applications helps borrowers prepare more effectively before requesting an auto refinance quote.

Primary evaluation factors include:

- Credit profile and payment history

- Remaining loan balance

- Vehicle age and mileage

- Loan-to-value ratio

- Income stability and debt levels

Vehicles that are newer, have reasonable mileage, and retain market value typically qualify for better refinancing terms.

Likewise, borrowers with consistent payment histories are viewed as lower risk.

Best Lenders to Request an Auto Refinance Quote From 🏦

Several lenders consistently rank well for transparency, competitive rates, and refinancing flexibility in the U.S. market.

Capital One Auto Refinance is widely known for its online prequalification tools, allowing borrowers to check offers without impacting credit scores.

RateGenius functions as a comparison platform, connecting borrowers to multiple refinance lenders through a single application.

LightStream appeals to borrowers with strong credit profiles by offering low APRs, no fees, and flexible loan amounts.

These lenders illustrate how refinance quotes can vary significantly depending on borrower profile and lender strategy.

Refinance Quote Comparison Table 📊

| Lender Type | Credit Focus | Typical APR Range | Key Advantage |

| Online Banks | Good to excellent | 4.5% – 7% | Speed and transparency |

| Credit Unions | Fair to good | 4% – 6.5% | Lower rates, flexible terms |

| Marketplaces | Wide range | 5% – 9% | Multiple offers at once |

| Captive Lenders | Brand-specific | Varies | Loyalty incentives |

How a Quote Can Reduce Total Loan Cost 💰

Beyond lowering monthly payments, a strong auto refinance quote can significantly reduce the total interest paid over the life of the loan.

For example, refinancing from a high APR dealership loan to a lower-rate credit union loan can save thousands of dollars, even if the monthly payment reduction seems modest.

Key cost-saving elements include:

- Lower interest rates

- Optimized loan term length

- Reduced interest accumulation

- Elimination of unnecessary add-ons

Borrowers who evaluate total loan cost rather than monthly payment alone tend to make more financially sound decisions.

Common Mistakes When Reviewing a Quote ⚠️

Even competitive refinance offers can become costly if borrowers overlook critical details.

Common refinancing mistakes include:

- Extending the loan term excessively

- Ignoring total interest paid

- Overlooking fees or penalties

- Refinancing vehicles close to payoff

- Accepting the first quote without comparison

The smartest approach involves reviewing multiple quotes side by side and focusing on long-term impact rather than short-term relief.

Preparing to Request a Strong Auto Refinance Quote 📋

Preparation increases approval odds and improves quote quality.

Before requesting an auto refinance quote, borrowers should:

- Check credit reports for errors

- Know current loan payoff amount

- Verify vehicle value

- Calculate realistic monthly payment goals

- Compare at least three lenders

This preparation allows borrowers to approach refinancing confidently and avoid rushed decisions.

Auto Refinance Quote Savings Scenario Table 📊

| Scenario | Original APR | New APR | Long-Term Savings |

| Dealer Loan Refinance | 10.5% | 6.2% | $2,100+ |

| Credit Improvement | 9% | 5.8% | $1,700+ |

| Market Rate Drop | 8.2% | 5.5% | $1,500+ |

Unlock real savings by exploring Nissan Rogue price comparisons across trims, dealers, and online incentives to make your purchase smarter.

How Auto Refinance Quotes Support Financial Stability 🛣️

An auto refinance quote is more than a pricing tool; it is a financial planning resource. Lower payments free up cash for savings, emergency funds, or debt reduction in other areas.

Refinancing also allows borrowers to align loan terms with life changes, such as income shifts or new financial priorities.

When approached strategically, auto refinancing becomes a tool for stability rather than temporary relief.

Why an Auto Refinance Quote Can Be a Smart Financial Reset 🔄

Requesting an auto refinance quote empowers borrowers to reassess their financial commitments and make adjustments based on current circumstances.

Rather than remaining locked into outdated loan terms, refinancing creates flexibility and opportunity.

Drivers who proactively explore refinance options often regain control over monthly budgets and reduce long-term financial pressure.

The key lies in careful comparison, realistic expectations, and strategic timing.

FAQ ❓

- Does requesting an auto refinance quote affect my credit score?

- Most lenders offer prequalification with soft credit checks that do not impact scores.

- How often can I request an auto refinance quote?

- You can request quotes anytime, though refinancing usually makes sense after credit improvement or rate changes.

- Can I refinance an auto loan with negative equity?

- Some lenders allow it, but terms may be less favorable.

- Is refinancing worth it late in the loan term?

- It depends on remaining balance and interest savings potential.

- Can an auto refinance quote lower my monthly payment immediately?

- Yes, approval typically replaces the existing loan once finalized.